The advantages of renewables vs fossil fuels

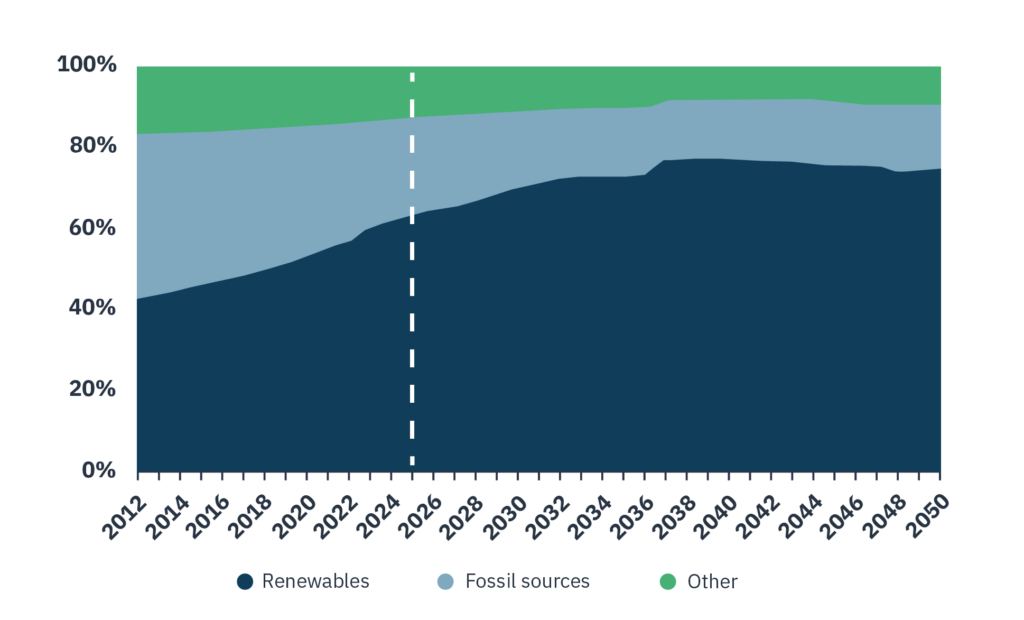

Renewable energy is on the up. The International Energy Agency has predicted that renewables will overtake coal to become the world’s largest source off electricity generation by early 2025i.

Global energy mix estimates (% mix of total generation)

Compared to traditional fossil fuel intensive sources of energy, investments in renewable energy:

- Deliver better returns in advanced economiesii,

- Is not subject to the geopolitics that play a significant role in the availability, and price, of many fossil fuelsiii,

- Experienced lower volatility and delivered higher total returns on the stock market (over the ten years from 2010 to 2020iv).

Total returns for green power beat fossil fuels globally in the last 10 years

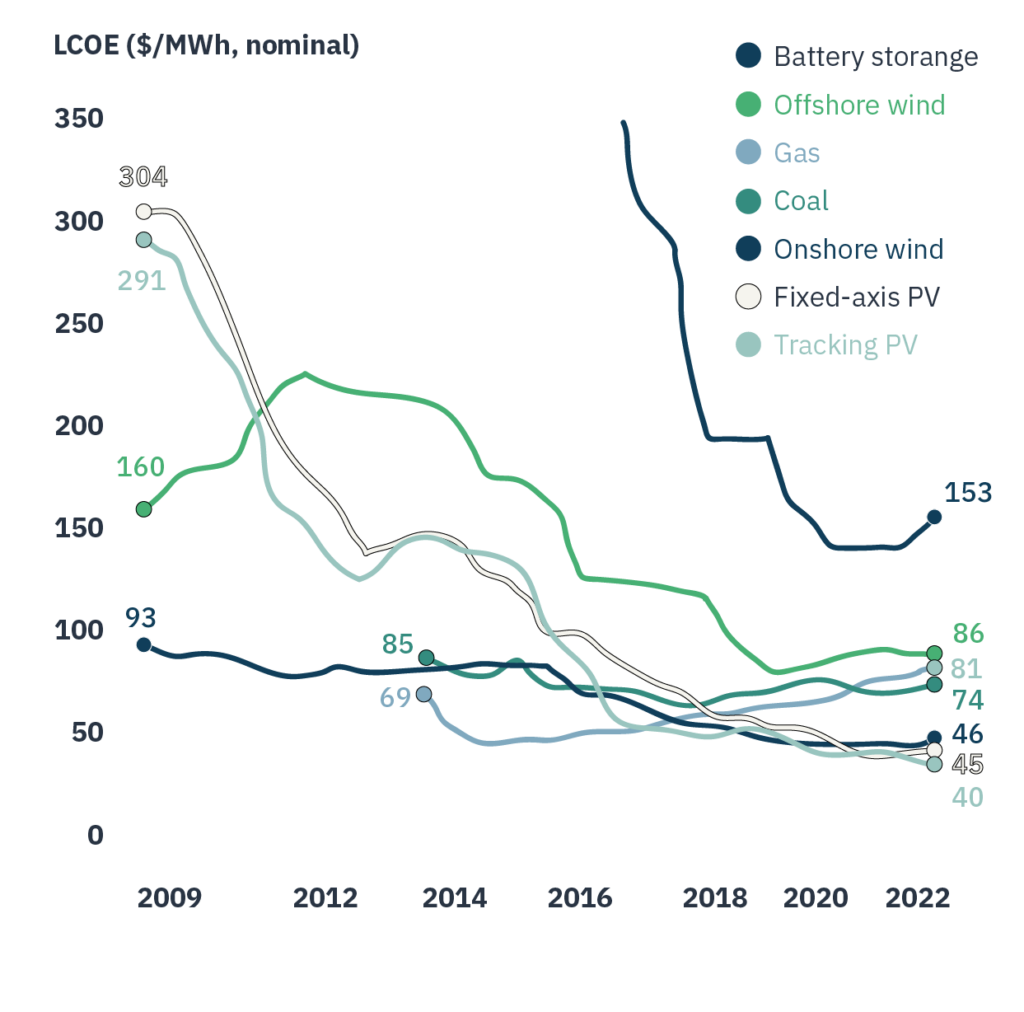

The costs associated with renewable energy have continued to fall in the last five years, bringing both solar (PV) and onshore wind to well below the costs of gas and oil, with offshore wind trending towards the same.

Global levelized cost of electricity benchmarks

N.b. The global benchmark PV, wind and storage is a country-weighted average using the latest annual capacity additions. The storage LCOE is reflective of a utility-scale LI-ion battery storage system with four-hour duration running at a daily cycle and includes charging costs.

By helping shift the global energy mix away from fossil fuels, renewables can provide a positive social impact by easing the soaring economic burden of volatile energy bills, in a sustainable way.

Risk management and diversification

Half the world’s fossil fuel assets (totaling £8.1 tn – £10.3 tn) could become worthless by 2036v as demand falls. The resulting excess of supply and potential stranded assets could result in long-term detrimental impacts on an investment portfolio.

Demand and supply shocks to world oil and gas prices caused by global political and social events in recent years have illustrated the volatility of the fossil fuel market. Geopolitical events can disrupt supply, driving prices up, while economic declines often decrease demand, causing prices to fall. This correlation to market events can result in reduced diversification benefits of incorporating energy into a wider portfolio.

Crude oil price over the last 50 years

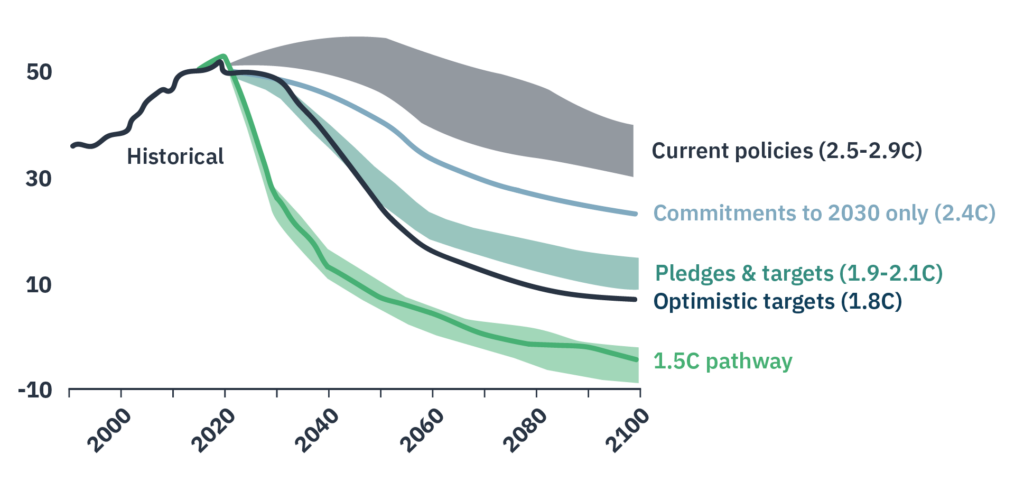

Projected trends and the impact of emissions

Under current policies and economic activities, we are not on track to meet the global decarbonisation targets set out in the Paris Agreement.

Global greenhouse gas emissions in gigatons of carbon dioxide equivalent

Globally, a shocking 8.9 million deaths per year are linked to air pollutionvi – a figure which will likely increase if no active change is made. By increasing our production and usage of green energy over fossil fuels, lower levels of greenhouse gases are released into the atmosphere.

Investing in renewables can mitigate the worst effects of climate change and improve people’s health while supporting a Net Zero, sustainable, portfolio and the transition to a Net Zero world.

The Carbon Intensity of Electricity Generation (In g CO2eq/kWh)

Summary

Renewables are a reliable, long-term and sustainable alternative to fossil fuels. They are cleaner, better both for the environment and human health, are not finite and offer lower volatility returns for investors compared to traditional energy sources.

Be a part of the action. Get in touch to find out how we can support your renewable investment journey to secure attractive, diversified returns whilst creating a more sustainable and energy efficient future.

Bluefield, powering a sustainable future.

[i] International Energy Agency, 2022

[ii] Imperial College Business School, 2020

[iii] Melodia and Karlsson, 2022

[iv] Bloomberg, 2021

[v] Mercure, 2021

[vi] The World Counts, 2022