Please click the link below to the pre recorded audiocast for the Bluefield Solar Income Fund – Full Year Results.

Bluefield wins ‘Sector Specialist of the Year’ at Sustainable Investment Awards

Bluefield named ‘Sector Specialist of the Year’ in recognition of ESG investment strategy and outcomes

On October 14th, the Bluefield team were proud recipients of the ‘Sector Specialist of the Year award’ at the annual Real Deals Sustainable Investment Awards, held this year at the London Marriott Hotel, Grosvenor Square.

The award recognises firms that demonstrate strong ESG outcomes across their portfolios through effective integration of ESG within investment strategy, data collection, analysis, reporting and policies.

In reaction to the award win, Max Saber, Group Senior ESG Analyst, said, “I am very proud that Bluefield has been recognised for this award. The continued work by the team and wider colleagues at Bluefield to forge relationships with public and private partners not only demonstrates tangible sustainability benefits, but also serves as wider benchmarks and tools for good practice in the industry.”

Max’s colleague in the ESG team, Georgia Whitehouse, added, “This is not just an ESG team achievement – it’s a collective one and reflects the strength of our integrated approach to delivering positive environmental and social outcomes alongside financial returns.”

The full list of winners can be viewed here.

Georgia Whitehouse wins IJ Global’s ESG Rising Star Award

Bluefield’s Group Senior ESG Analyst was honoured at the IJ Global ESG Awards in London

On Thursday October 9th, Group Senior ESG Analyst Georgia Whitehouse was presented with the prestigious ‘Rising Star’ award at the annual IJ ESG awards in a ceremony held at the Sheraton Grand London Park Lane.

The award celebrates ‘an individual in an ESG focused role who has made a demonstratable impact in the energy and infrastructure community on the ESG front’.

Feedback from the independent panel of judges noted, “Georgia has led award-winning research on circularity in solar infrastructure, producing industry-facing tools and policy recommendations. Her ERALD project has influenced thinking on end-of-life asset management and was presented at the House of Lords. While early in her career, her impact is tangible and growing.”

Speaking in reaction to the award, Georgia said, “It is an honour to receive this recognition. Advancing circular economy principles in renewable energy presents both complexity and opportunity – I am grateful to my colleagues at Bluefield, as well as our academic and industry partners, for their collaboration and insight.”

Emma Silcocks, Group Head of ESG, added, “Since joining Bluefield, Georgia has delivered a number of projects to drive forward Bluefield’s sustainability efforts, including innovative work around the circular economy and climate resilience. Anyone who has worked with Georgia knows the energy, dedication, and passion she brings to her work, and on top of this, she is a kind and caring colleague who goes above and beyond to support those around her. We are very proud of her achievements.”

ERALD II: Roadmap for the photovoltaic industry

The second phase of the End of Renewable Asset Life Decisions (ERALD) research partnership between Bluefield and Lancaster University has delivered a roadmap to advance a more circular solar industry

Last year, Bluefield entered into a research partnership with Lancaster University geared towards developing solutions for end-of-life practices within the solar industry and creating greater circularity therein.

This was the genesis of the End of Renewable Asset Life Decisions (ERALD) research partnership, which has been led by Group Senior ESG Analyst Georgia Whitehouse and has been partially funded by the Bluefield Solar Income Fund (BSIF), of which Bluefield Partners LLP act as Investment Adviser.

Phase one of this project, known as ERALD I, focused on applying the concept of materials passports to a new build solar farm within BSIF’s portfolio and can be read about here. This project was recently recognised at the Environmental Finance Sustainability awards, winning the ‘ESG Innovation of the Year (research)’ award.

The second phase of the project, ERALD II, was announced earlier this year with the expressed aim of analysing existing industry practices and the latest available research, in relation to end-of-life options for solar assets and circularity, with a view to developing an industry roadmap for future research, innovation, and policy engagement.

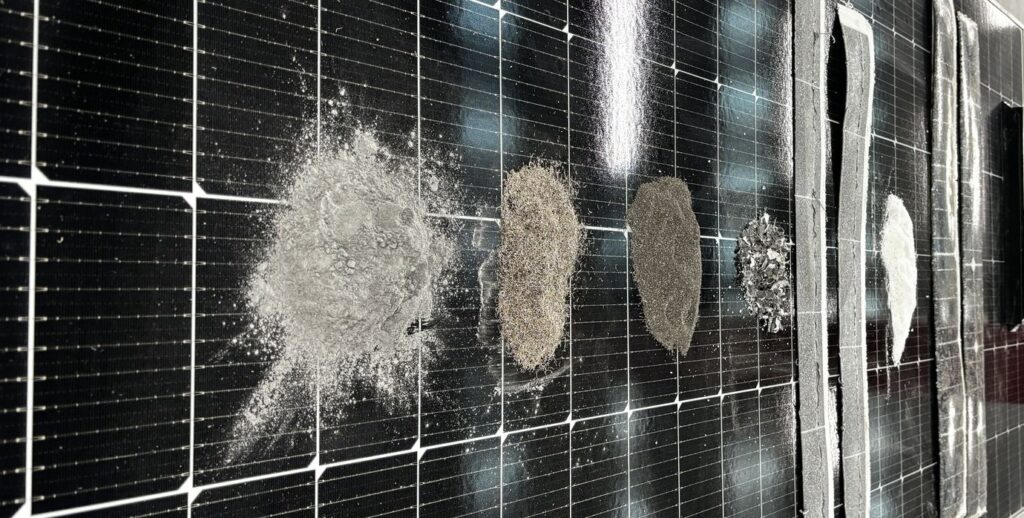

Here, we are delighted to unveil the white paper and roadmap for the solar photovoltaic (PV) industry, which includes ten recommendations to address challenges associated with the end-of-life phase of PV panels and unlock circularity within each stage of the value chain.

The roadmap provides a summary of the recommendations from the whitepaper, highlighting where opportunities to adopt the concepts of circular economy exist. For instance, the re-manufacture of PV panels using recovered materials is emphasised, as well as life extension strategies during the operational phase to extend the useful life of materials and minimise waste.

The yellow lines in the diragram illustrate the crucial role of data transparency and accountability in guiding decisions throughout the lifecycle of a PV panel. The white lines represent potential reuse pathways, while the light blue dashed lines indicate opportunities to recycle materials from manufacturing processes or early loss PV panels at each stage of the supply chain, maximising resource efficiency and embedding circularity within the system.

The white paper, produced by Lancaster University, provides further detail on each recommendation, its rationale, and next steps.

Please view the full white paper below:

Roundtable: Responsible investors fight back against ESG enmity

Group Head of ESG Emma Silcocks joined a roundtable of specialists to discuss practices within the renewable energy sector, ESG perception risk and the evolving focus of sustainable investors

In the July edition of Infrastructure Investor, Group Head of ESG Emma Silcocks joined a panel of sustainability experts to discuss the status of ESG within the context of the Trump administration and the subsequent scrutiny that has been applied to sustainable investing.

In particular, Emma discussed how ESG practices within the renewable energy sector have matured, and the recent evolution of investor focus from achieving net zero and reducing greenhouse gas emissions towards enhancing climate resilience.

Read the full roundtable below:

Striving for circularity: The ERALD Project

With the first wave of solar panels approaching their end-of-life stage, there is an opportunity to create greater circularity within the industry

Since the turn of the century, the renewables industry, and particularly ground-mounted solar, has scaled rapidly in order to meet the urgent need to both decarbonise the energy mix and provide additional energy security to the UK. To contextualise, here in the UK, there are 1,336 operational solar farms according to the latest government data, with 142 under construction and a further 1,957 waiting to be built. The growth in solar has been rapid and shows little sign of slowing down.

However, as the sector matures and as the first generation of solar assets in the UK approach the end of their operational lifespans (typically, 25-40 years), the sector faces a growing volume of photovoltaic (PV) waste. This, paired with limited recycling infrastructure and complexities in finding solutions for diverse solar technologies, presents a challenge – and an opportunity – which has been receiving increasing attention from the industry, investors, and the media.

In addition to addressing the potential environmental impact of waste materials, opportunity lies in improving circularity by reusing materials and reducing waste, unlocking both emissions reduction opportunities and value in constituent materials.

By circularity, we are referring to resource efficiency and the minimisation of waste, considering elements such as the durability, re-use, and recycling of renewable energy infrastructure and components.

Having identified this issue, we took the opportunity to proactively address the prospect of industry circularity directly by partnering with Lancaster University to investigate responsible end-of-life practices for the solar industry.

This culminated in the formation of the End of Renewable Asset Life Decisions (ERALD) research partnership which leverages the University’s cross-disciplinary expertise in energy sustainability to explore innovative approaches to circularity in the management of solar assets. The Bluefield Solar Income Fund (BSIF), of which Bluefield Partners act as investment adviser, subsequently dedicated funding to support research and innovation in this area.

Here’s what we’ve learned so far.

Research process

The first project, ERALD I, focused on applying the concept of Materials Passports, a digital tool designed to track the composition of materials and support reuse and recycling, to BSIF’s recently constructed 50MW project, Yelvertoft Solar Farm. The research team mapped the materials and components used onsite, drawing information from a series of collaborative workshops, comprehensive desktop research and manufacturer datasheets.

A site visit to Yelvertoft Solar Farm enabled university researchers to engage directly with experts from the Bluefield Group and the external Engineering and Procurement Contractor (EPC) partner building the site.

The project aimed to:

- Enhance visibility into the material composition of solar assets

- Identify barriers to recycling and reuse across the value chain

- Explore how circularity can be integrated into the development of new assets

- Assess the feasibility of Materials Passports as a tool to support more circular practices

Key findings

The research yielded four main insights:

- Tools like Materials Passports show promise, but their effectiveness depends on broader industry adoption and data transparency from manufacturers

- Circularity requires collaboration – circularity cannot be achieved in isolation. Solutions must be co-developed across the industry and supply chain

- Proactive maintenance plays an important role in extending the useful life of components and optimising resource efficiency during the operational phase of the asset

- Policy evolution is essential – legislative frameworks, such as the EU’s Waste Electrical Electronic Equipment (WEEE) Directive, which focuses on electrical and electronic waste, must adapt to support circular practices in the renewables sector

Next steps

Following the conclusion of ERALD I, BSIF funded a second phase of research with the Lancaster team, which will take a more holistic view of the solar value chain. This project aims to map current practices, identify systemic barriers to a circular industry and propose a roadmap for future research, innovation and policy engagement. The findings, expected in July 2025, will inform BSIF’s internal circular economy strategy and contribute to wider industry dialogue.

As Investment Adviser, Bluefield has continued to assess the practical application of Materials Passports across the development, construction and operational phases of the asset lifecycle. Externally, we have been engaging with supply chain partners and industry bodies to raise awareness, encourage participation, and foster a collaborative approach to circularity.

In conclusion

Bluefield’s partnership with Lancaster, the ERALD project, was recognised at the Environmental Finance Sustainability awards, where we won the ‘ESG Innovation of the Year (research)’ award.

This was a wonderful acknowledgement of the work undertaken thus far, and of our ambitions for the ERALD project more broadly.

However, it’s important to acknowledge that achieving circularity in any industry is a complex, long-term objective and one that has a lot of moving parts.

As the demand for renewable energy infrastructure increases, it is increasingly important for companies to plan not only for the construction and operation of their assets, but also for the processing of equipment at the end- of-life. The ERALD research represents an early and important step in building the knowledge base and partnerships required to support a more sustainable and resource-efficient energy system.

We are at the beginning of what is, hopefully, a fundamental shift in our industry and how we approach end-of-life decommissioning. The concept of ‘end-of-life’ presents challenges, as it implies linearity, that this is an issue for the future. However, through our work with Lancaster and by considering the full supply chain, Bluefield hopes to pinpoint areas for improvement and identify ways to work together as an industry to move toward a circular economy.

Bluefield wins ESG Innovation of the Year (Research) award

The Bluefield team are delighted to have won the ‘ESG Innovation of the Year (Research)’ award at Environmental Finance’s Sustainability Awards 2025

The Bluefield team are proud to have won the ‘ESG Innovation of the Year (Research)’ award at Environmental Finance’s Sustainability Awards 2025.

The criteria of the award called for companies to demonstrate innovation in research into ESG factors. For this, we submitted our ongoing research project, ERALD, which we have been developing alongside Lancaster University.

ERALD is short-hand for End of Renewable Asset Life Decisions, and has focused on developing a more collaborative, circular economy within the renewable energy industry, and particularly with regard to solar PV.

Group Senior ESG Analyst Georgia Whitehouse, who has led on the research project, has written an in-depth overview of ERALD and its aims, which can be read here.

Of the entry, one Sustainable Investment Awards judge complimented the “interesting” project for seeking to address “an important and often overlooked issue”, while another echoed this sentiment, calling it an “excellent project solving a very real problem and praising it for being “very innovative, yet simple”.

Speaking on the award, Group Head of ESG Emma Silcocks said: “I am very pleased that Bluefield has won the ESG Innovation of the Year (Research) award for the ERALD research project with Lancaster University. This is a partnership which has been fostered and grown by Georgia, and is helping to drive responsible recycling practices for PV across the industry. A huge congratulations Georgia, Lancaster University, and all those across the Group who have supported this workstream to date”.

Read more about the awards here.

Bluefield banks on solar expansion despite global headwinds

James Armstrong, Founder and Managing Partner, spoke recently with Jessica Mills Davies of Energy Voice about the state of the market and Bluefield’s evolving business model

In an exclusive studio interview with Jessica Mills Davies, London Correspondent at Energy Voice, James Armstrong discusses how our evolving business model has been a ‘big driver’ of value creation.

James also discusses the renewables market more generally and, in particular, the challenges facing Investment Trusts, such as the Bluefield Solar Income Fund, which catalysed the Fund’s award-winning partnership with GLIL Infrastructure.

Click below to view the full video on Energy Voice:

Bluefield Solar Income Fund – Interim Results Audiocast

Please click the link below to the pre recorded audiocast for the Bluefield Solar Income Fund – Interim Results for the period ended 31st December 2024

BSIF and GLIL win ‘Joint Venture Acquisition of the Year – Europe’ award

The Bluefield Solar Income Fund (BSIF), of which Bluefield Partners are the investment manager, and GLIL Infrastructure were awarded the ‘Joint Venture Acquisition of the Year – Europe’ award at the IJInvestor awards on Thursday 28th, November.

The deal, structured in three phases, involved GLIL and BSIF forming a partnership in December 2023 to purchase a portfolio of 58 operational solar projects in the UK from Lightsource bp for £220 million ($285 million). This phase was completed in January.

The second phase began in July 2024, where GLIL acquired a 50% stake in BSIF’s 112 MW solar energy portfolio. This portfolio includes nine operational sites located in Southern and Central England and is supported by Renewable Obligation Certificates (ROC) accreditation. During this phase, the joint venture also financed the construction of 17 MW of new solar assets, which are expected to be connected to the grid within the next 12 months. The final phase of the joint venture will involve both partners investing in a selection of projects from BSIF’s development pipeline, which are anticipated to be connected to the grid in the next 2-3 years.

James Armstrong, Founder and Managing Partner of Bluefield Partners said, “The award recognises a multi-faceted partnership Bluefield Partners and GLIL that took collaboration, imagination and deep market knowledge to bring it to realisation. It is an agreement that has already created one of the leading solar vehicles currently operating in the UK. Credit to Bluefield’s and GLIL’s respective investment and commercial teams who had the vision to design such an innovative, multi-layered investment partnership.”

As noted in an article by IJ Global, one of the judges reportedly said: “A complex and multi-faceted transaction with very real complexity, combined with the successful combination of capital from entities with different investment theses, ie listed fund and a pension fund as well as demonstrating the ability to unlock institutional capital to address the UK Government’s push for investment in energy transition. Very impactful and innovative.”

Held at the world-famous Savoy hotel in London, the awards celebrated the best fund raising and deployment, as well as merger and acquisition activity in the energy and infrastructure sector, across several different categories. Lean more about IJ Global here.